On this page:

What is marketing and multimedia professionals insurance?

Business insurance helps protect their growing businesses. Depending on the cover you choose, it could help you manage claims costs like errors, damaged equipment, and legal expenses.

Errors in your work,, a cyber-attack , damaged equipment—the potential troubles for marketing and multimedia professionals never end.

Situations like these (and many others) could create unplanned expenses for your business. If paying these out of pocket would shake your business’ foundation, it may be time to consider business insurance.

Why might marketing and multimedia professionals need insurance?

You may be required to have business insurance to do things like:

To meet minimum coverage requirements.

Lease office space.

Work with specific clients.

Pay legal costs if you face a claim.

Types of marketing and multimedia professionals we cover

Every business is different, that’s why BizCover offers business insurance options to cater to your needs.

We cover a range marketing and multimedia professionals, including:

Advertising Service

Graphic Designers

Internet Advertisers

Marketing Consultant

Telemarketers

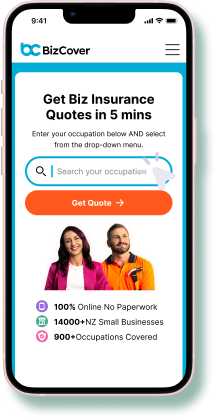

What does your business do?

Search your occupation, compare cover, and buy online in minutes.

Save time & money by buying online in minutes.

Types of cover we offer marketing and multimedia professionals

BizCover has insurance options for marketing and multimedia professionals

Tailor your quote to your business, compare cover, and buy online in minutes.

Unsure what types of business insurance to get? We’ve got you! Here’s what other marketing and multimedia professionals tend to choose:

Popular cover types for marketing and multimedia professionals:

Marketing and multimedia professionals could also consider:

Other Covers

Statutory Liability Insurance

Covers you for an unintentional breach of key NZ business legislation, including:

- Legal and defence costs

- Fines and penalties

Cyber Liability insurance

Covers your business from legal costs and expenses caused by cybercrime incidents such as:

- Data breaches

- Extortion

- Forensic investigation

- Business interruption

How much does marketing and multimedia professionals insurance cost?

Your small business is unique. That means you might face different risks than other businesses and may pay a different price for your cover.

With BizCover, insurance can be tailored to fit the size, risks, and needs of your business.

The prices are real, get that new policy feel

Professional Indemnity

$69.71/mo*

Expected average cost

Public Liability

$22.62/mo*

Expected average cost

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Professional Indemnity

$69.71/mo*

Expected average cost small businesses to pay

Public Liability

$22.62/mo*

Expected average cost small businesses to pay

Factors influencing cost

Your Industry

Required Coverage

Your Turnover

Number of Emplyees

Claims History

Click here to check industry wise average prices

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

You can select from 5 different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

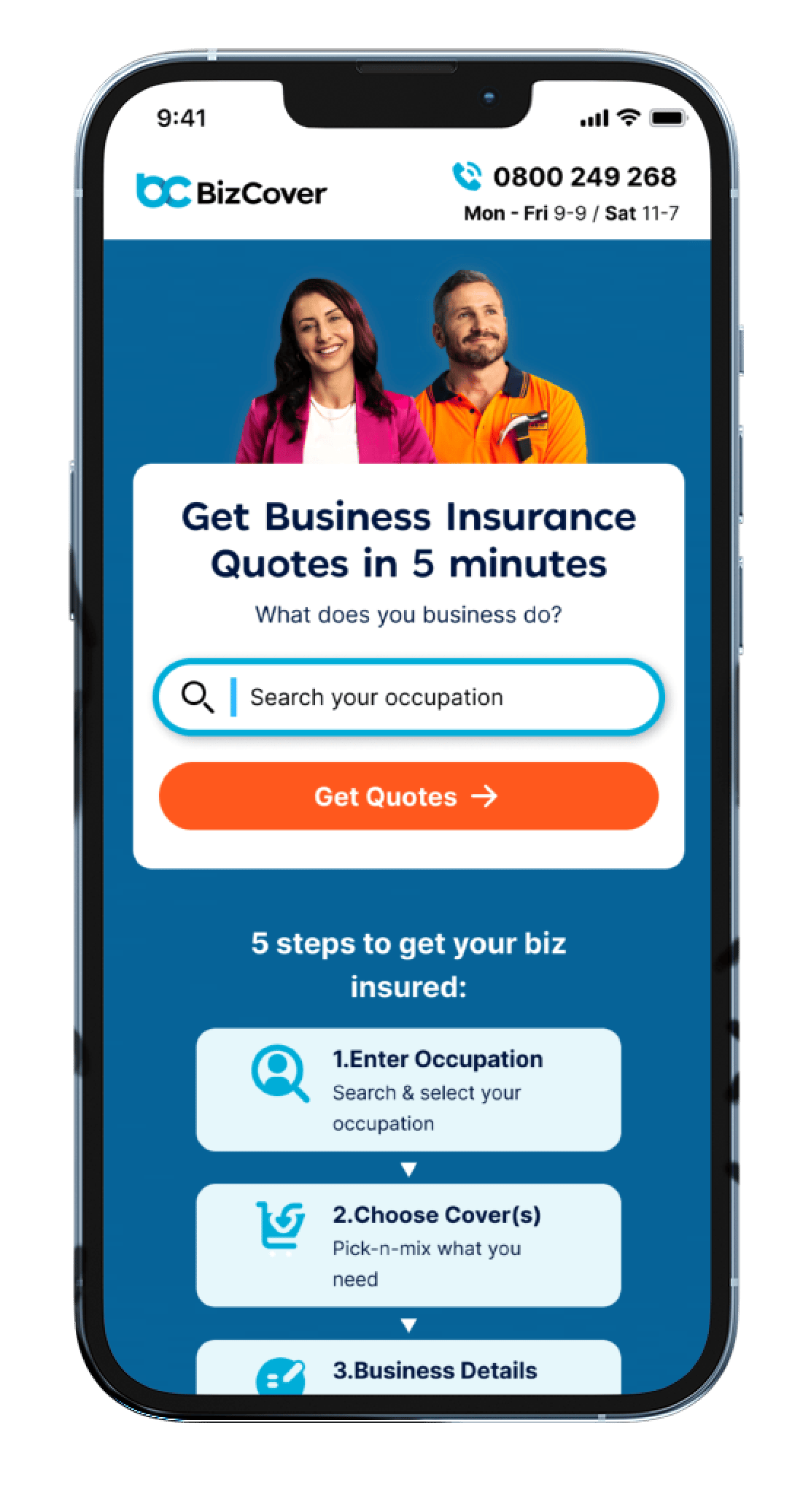

How it works – buying online

5 easy steps to get instant cover online today.

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

Search your

Occupation

Choose your

Cover(s)

Enter Business

Details

Compare

Quotes

Get Covered

Today

How it works – making a claim

We’ll assist you through the claims process & manage your claim directly with the insurer.

Let us know Fill out our claims form and provide info to support the claim

Receive extra support We will assist you with your claim

Claim results We will notify you of the claim outcome.

Let us know Fill out our claims form and provide info to spport the claim

Receive extra support We will assist you with your claim

Claims results We will notify you of the claim outcome

Our Insurers

We work with a selected group of trusted NZ insurers to offer you great cover.

The savings are real

See how much others have saved while purchasing policy through Bizcover

^ Savings made from January 2023 to July 2024. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

What sets BizCover apart?

We are not just a comparison and buy site.

Make Claims Online

We’ll manage the process on your behalf with the insurers.

Flexi Payment Options

Pay monthly or annually, cancel at any time.

One Stop Shop

Manage multiple cover types in one place.

Easy Renewals

Optional automatic renewal to stay protected.

15000+ NZ

small business covered